Importing and exporting with DHL

The University has a contract with DHL who should be used when you are in control of selecting the carrier.

Use DHL Express for:

- Domestic shipments within the UK

- Small international packages under 40kgs that do not need a Material Transfer Agreement

Use DHL Global for:

- International shipments above 40kg

- Any international or UK domestic shipments that need a Material Transfer Agreement

The Importing_Goods_How To_Guide contains guidance on all aspects of importing goods, including commodity codes, Incoterms and import duties.

For further advice and information, please see the VAT & Tax pages.

Overview

Any goods purchased or moved from the EU into the UK, is classed as an import.

The import must be declared to HM Revenue and Customs (HMRC) correctly and any applicable import duty, VAT and other taxes must be paid to avoid penalties and delayed arrivals.

HMRC will hold the University responsible for any error on submitted declarations.

The University’s EORI Number is GB 142 047795000

Steps

Determine the full price of the goods

The value is usually the full amount paid to the supplier including delivery and insurance costs. If there is no sale (including hiring, leasing or return of our own goods) the open market value (i.e. the price if they are purchased) plus shipping and insurance should be used.

The supplier may have provided these details on a ‘commercial invoice’, or be able to provide the UK commodity code for import purposes and should know the commodity code they will use for import. This should be checked.

If the total value of the individual consignment is below £135, no import duty will be due but the University will have to account for UK supply VAT via self-assessment as applicable.

Confirm commodity code on the UK Trade Tariff to obtain the import duty rate

Every type of item imported has a code number. The supplier may have provided, or be able to provide the UK commodity code for import purposes and should know the commodity code they will use for import.

- For imports form 01/01/2021, please check the new UK Global Tariff

- Some of the most commonly used commodity codes and their related duty and VAT rates (before any relief is applied) are shown below:

|

Commodity Code |

Description |

Import Duty Rate |

VAT Rate |

|

38220000 00 |

38 Misc chemical products, 22 Diagnostic or lab reagents on a backing, prepared diagnostic or lab reagents whether or not on a backing, other than those of heading 3002 or 3006; certified reference materials |

0% |

20% |

|

29349990 90 |

29 Organic chemicals, 34 Nucleic acids and their salts, whether or not chemically defied; other heterocyclic compounds, other, other, other, other. |

6.5% |

20% |

|

49019900 00 |

49 Printed books, newspapers, pictures and other products of the printing industry; manuscripts, typescripts and plans, 01 Printed books, brochures, leaflets and similar printed matter, whether or not in single sheets, other, other. |

0% |

0% |

|

39269097 90 |

39 Plastics and articles thereof; 26 Other articles of plastics and articles of other materials of headings 3901 to 3914, other, other, other, other. |

6.5% |

20% |

|

90189084 00 |

90, Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof, 18 Instruments and appliances used in medical, surgical, dental or veterinary sciences, including scintigraphic apparatus, other electromedical apparatus and sight-testing instruments, other instruments and appliances, other. |

0% |

20% |

Consider what Incoterms apply to the import

Incoterms are a set of internationally recognised rules that define the responsibilities of sellers and buyers. They specify who is responsible for paying for and managing the shipment, insurance, documentation and customs clearance

They determine:

- Where titles passes (i.e. legal ownership)

- Who is responsible for delivery to where

- Who has the insurance risk

- Who is responsible for the import into the UK

The most common Incoterms are:

- Ex-works (EXW) – customer collects and title passes at supplier’s premises

- Free on board (FOB)/Free carriage (FCA) – supplier delivers to nominated port in their country (e.g. FOB Shanghai)

- Cost, insurance and freight (CIF) – supplier pays for delivery to a port in UK

- Deliver at Place (DAP) – supplier delivers door to door, but customer clears customs.

- Deliver Duty Paid (DPP) – supplier does everything.

Ex works should be avoided, as title passing in the country of supply can lead to tax issues, such as the need to register for VAT/GST in that country.

Deliver Duty Paid (DDP) is the preferred Incoterms to use. The supplier will be responsible for the customs clearance and import taxes and should raise an invoice charging the University UK VAT where applicable.

If the supplier cannot use DPP, Deliver at Place (DAP) is often the next best option but the University will be responsible for clearing the goods through customs and paying import duty/VAT where applicable.

The supplier will often state the Incoterm they plan to use on their quote and other documents.

Consider who will clear the goods through Customs

Any import declaration will need to be submitted on the behalf of the University, by a freight forwarder, courier, fast parcel operator or customs broker. They will charge fees for clearing the goods and for facilitating payment of the import taxes. The University’s preferred courier/customs broker is DHL Global.

In many cases suppliers will appoint fast parcel operators (e.g. DHL) who specialise in quick delivery from door to door and will attempt to clear goods into the UK on the University’s behalf.

In all cases, please ensure there is a customs broker or similar in place to declare and clear goods through UK customs.

Consider whether and duty or VAT reliefs apply

Do not consider import duty relief on items under £1000 as the costs of administering the relief can significantly exceed the benefit

If there is a nil rate of duty under the UK Global Tariff, an application is unnecessary.

Import duty relief can be claimed on:

- Scientific instruments imported for educational purposes or non-commercial scientific research

- Purchased/donated medical equipment to be used for medical purposes contact VAT@exeter.ac.uk if this may apply and you require further support.

Medical VAT relief may also be claimed on specific goods and medicinal products substances used for a qualifying medical purpose. Please refer to the VAT intranet for further details https://www.exeter.ac.uk/departments/finance/taxandvat/

Import duty and VAT relief can be claimed on goods imported for testing to destruction. Please ensure the import courier is aware of these instructions prior to shipment into the UK.

Consider whether any import controls or import licenses apply

There are controls in place for the import of firearms, artworks and antiques, plants and animals, medicines, textiles and chemicals an import licence may be required.

Further information to apply for a licence.

Complete the Import Notification form and send a copy to the supplier and freight forwarder

Include your special instructions, certificates or authorisations on the notification form sent to the freight forwarder and supplier. They will submit the import declaration to HMRC as part of the customs clearance process on the University’s behalf.

Ensure a copy of this documentation is retained by the College for future audit requirements.

Pay and import taxes that may be due via freight forwarder or customs broker

The University does not have a deferment account and does not use Postponed VAT Accounting. The College must pay any taxes due to the freight forwarder or customs broker. Charges will be made for customs clearance, as well as facilitating payment to HRMC.

If clearance is administered by DHL Global, a purchase order can be raised and DHL will invoice the University.

In other cases, the freight forwarder/customs broker or similar often requires immediate payment to release the goods. Paying import taxes and administration fees with a purchasing card is the preferred option to minimise delays.

The freight forwarder will provide an invoice or request for payment and other supporting documentation (e.g. air waybill) in order for the payment to be made. This should be processed in T1 in the usual way to ensure payment is made in a timely manner.

Obtain the required import evidence from the freight forwarder

The following documents should be retained by the College: airway bill/bill of lading, C88 (official customs evidence), delivery note, commercial invoice and any other relevant information.

These documents need to be retained for 6 years in case of HMRC audit.

Please provide clear instructions in advance to the freight carrier if you are:

- Temporarily importing into the UK goods that will be re-exported

- Temporarily exporting goods that will be re-imported back to the UK

- Importing goods that will be processed or repaired before being re-exported again

- Exporting the University’s own goods for repair or processing that will be re-imported once again.

Appendix 1

Purchase of goods – Low value consignments not exceeding £135 in value (from 01/01/2021)

Where the supplier is based outside the UK and the value of the consignment is below £135 in value, ‘UK supply and VAT’ will apply on the purchase. This means:

- The University’s VAT registration number should be provided to the supplier

- The supplier will quote the reference ’reverse charge’ on the invoice

- UK supply VAT (rather than import VAT) will be due via self-assessment, this will be debited to the same finance code as the (net) payment for the goods

- No import duty will be payable, but a customs declaration will still need to be submitted, via a freight forwarder or agent.

The £135 threshold is based on the sales cost of the full consignment (not on each individual item within it). It does not include:

- Transport and insurance costs, unless they are included in the price and not separately indicated on the invoice

- Any other taxes and charges identifiable by the customs authorities from any relevant documents.

Appendix 2

Import Licences

The UK government has import controls in place for the following goods which may require an import Licence:

- Firearms and ammunition

- Certain plants, seeds and soil

- Animal and animal products

- Certain controlled drugs and medicines

- Precursor chemicals, pesticides, ozone depleting substances (ODS) amongst other chemicals

For further information, please see government guidance, getting the right licences for international trading

Appendix 3

Preferred Courier/customs Broker

DHL Global is the University’s preferred courier/customs broker.

If the goods are to be delivered by the suppliers’ appointed carrier, but you wish to use DHL Global to submit the import declaration and pay any taxes arising, please ensure that the supplier is instructed to consign the goods to the University of Exeter c/o DHL Global

Contact DHL Global to obtain a price for clearance charges and use of their deferment account to pay any import taxes. They will also require:

- The carriers airway bill number

- A copy of the completed Import Notification form

If you do not already have access to the University DHL Express account, please email procurement-operations@exeter.ac.uk quoting ‘DHL EXPRESS’ in the subject title. You will then be sent an invitation to sign in and create a password.

Existing individual DHL Express accounts will close on 1st September 22. All users who have raised a DHL Express purchase order within the last 12 months will have received a link to register on the University's new group account. Unless otherwise requested, all users will be grouped by Faculty which will give visibility of all shipments made within that group.

Using DHL Express is a three-stage process:

- first get a quote from DHL Express

- then create and receipt a purchase order in T1

- then confirm the booking with DHL Global on their website.

Quotes cannot be saved and returned to later so you must have access to T1 in order to accept a quote and turn it into a confirmed collection/delivery.

Any staff or students who can use T1 to create the PO can use DHL Express to arrange shipping.

Using DHL Global is a three-stage process – first get a quote from DHL Global, then create and receipt a purchase order in T1, then confirm the booking with DHL Global on their website.

Any staff or students who can use T1 to create the PO can use DHL Global to arrange shipping.

DHL Global should ALWAYS be used for:

- Material Transfer Agreement (MTA) shipments regardless of weight. This will ensure correct guidance is given from the dedicated Life Sciences team at DHL Global.

- Advice on temporary imports/exports to ensure the item is shipped on the correct terms to avoid incorrect taxes being applied. Depending on weight, it may be possible to use DHL Express but DHL Global will advise on a case-by-case basis.

Don’t use DHL Global for:

- Domestic shipments within the UK – instead use DHL Express(T1 supplier 107014).

- Small packages under 40kgs that do not need an MTA. These may be refused by DHL Global and they may refer you to use DHL Express instead.

Use the guidance below to help make sure your VAT zero rate purchase is imported into the UK as smoothly as possible:

1. Identify who is responsible for the import – supplier or University?

2. Ensure a copy of the VAT declaration goes to the supplier with the purchase order:

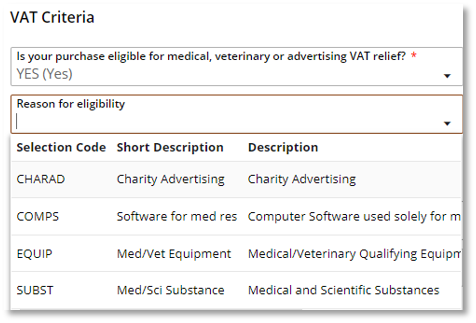

When creating the requisition in T1, select the VAT drop down box in T1 as ‘yes’ and pick the relevant elgibility reason.

When the purchase order is approved, T1 will then attach a VAT declaration for zero rate to the purchase order when it is emailed to the supplier.

3. Ask the supplier to attach the VAT declaration to their export documentation.

4. Find out which port or airport the shipment will arrive into the UK?

5. If the University is responsible for the shipment contact Liz Anslow at DH Global- elizabeth.anslow@dhl.com - to arrange clearance and help ensure the shipment is delivered to the University in Exeter.

6. Make sure Liz Anslow is aware of when and where the shipment is coming into the UK.

7. Above all make sure DHL have a copy of the VAT declaration to ensure the item clears HM Customs without any VAT added.